Objective

Background

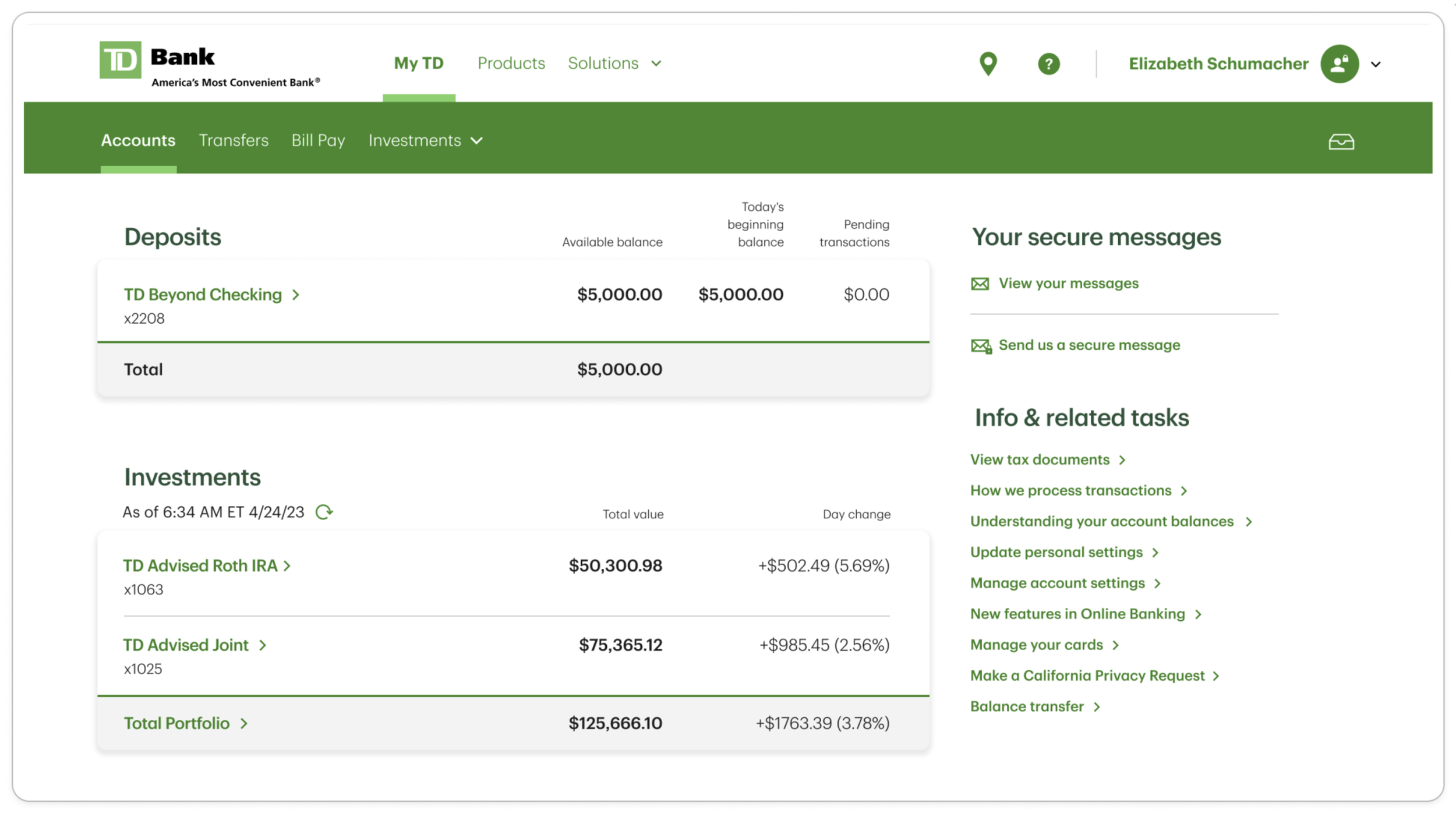

When I joined, incorporating Wealth Management into a “One TD” customer first service was a core tenet of the overarching bank strategy. TD had plans in place to significantly grow it’s US based Wealth advice business and had been servicing their clients with bare bones, unbranded third party solutions that had separate logins from the retail banking customer experience. In addition, accounts like trusts were housed in separate systems, forcing many customers to login into multiple portals to view and manage investments.

TD Wealth’s strategic goals included growing their investment advice business, retaining existing customers and attracting new clients. Creating a digital experience that integrated with retail banking and captured the TD brand, was a key strategic initiative for the business.

Solution

Wealth client portal concept design and MVP delivery.

Secure client application that seamlessly integrates with TD.com.

My Role

Service Design Director

Project Deliverables

• Stakeholder engagement

• Design strategy

• Management & planning

• Ethnographic research

• Customer segmentation / personas

• Competitive analysis

• Product vision & feature priority

• Mid & High fidelity prototypes

• Concept evaluation

• Annotated wireframes

• Visual design

Project kickoff

TD’s design partnership with TD Wealth began four months before I started at TD. During this time, an agency was hired to facilitate an ethnographic research study to help TD Wealth better understand both their customers and the competitive retail investment landscape. The agency engaged in discussions and workshops with the stakeholder team and contextual interviews that included retail investors from TD’s top competitors. From this work, core recommendations for next steps were crafted, including an initiative to explore a revamp of the secure customer experience across TD’s main customer segments.

The ultimate goal TD Wealth wished to achieve was to grow their investment advice business, retain existing customers and attract new clients. They saw an integrated digital retail portal that felt like a TD branded experience, as a key strategic initiative for the business.

Key recommendations

Lead with human needs

Consumers have different wants and needs, and those preferences change over time. Continue to put people at the center of experience design to build trust and grow with them through life stages.

Omnichannel experience

People engage with TD across numerous channels and experiences, including advisor and branch interactions, but see one TD brand experience. Create an omnichannel experience to eliminate fragmentation.

Integration between Retail Banking & Wealth

Consumers are looking for one source of financial wellbeing. Enhance integration between retail and wealth to convert existing customers and provide a holistic experience.

Digital first experiences

Lead with digital-first and mobile to make it easy to get started. Support ongoing engagement to retain customers over time.

Northstar goals for best-in-class experiences

Make it easy to start

A ‘One TD’ customer experience, with intuitive navigation, bridging retail and investment accounts.

Trusted brand experience

Improved investor confidence and customer retention through a unified TD branded experience.

Adapt to my investment journey

Alignment to customer expectations for industry best digital advice and wealth management experiences.

Scalable systems

A scalable digital experience that can encompass future features and needs like personalization.

From our stakeholders

“The successful experience will meet the customer where they are in their financial journey and provide the tools, knowledge, guidance and advice they need to attain their goals.”

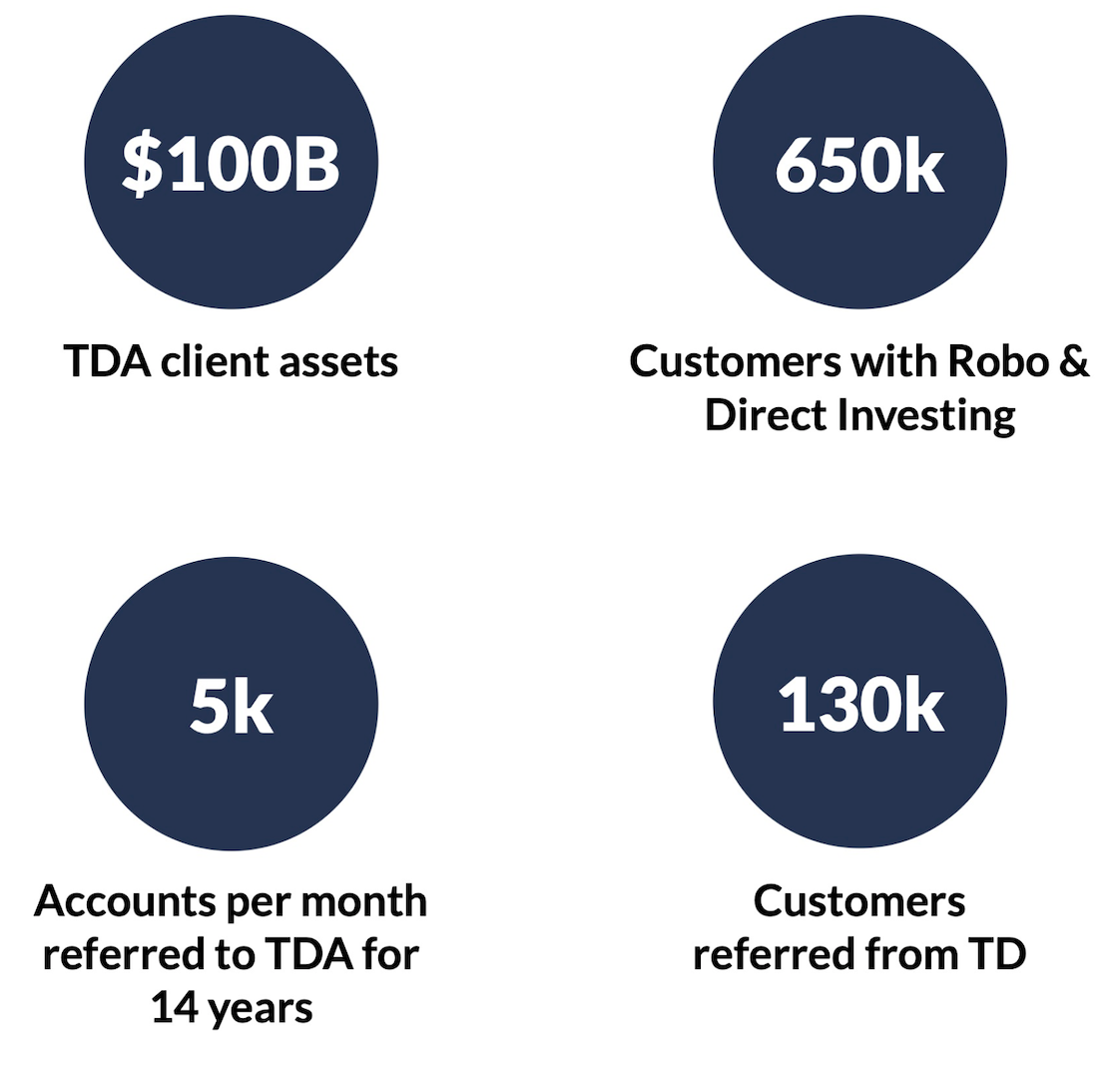

Our audience

To zero in on the advised customer, I partnered with Phase5 (research consultancy) to perform ethnographic studies in order to better understand investment advice behavior and customer needs across TD Wealth’s major customer segments. These included mass market (assets less than $100K), mass affluent (assets above $100K and below $750K), and high net worth (assets more than $750K).

A main focus was the retention of mass affluent customers, TD’s largest market share in total volume of assets, as a priority for our day one deliverables.

Alignment

Our discovery prioritization

In total, there were 12 executive stakeholders, each with varying opinions on what the client experience should include for a first phase deliverable. To gain consensus, I conducted a prioritization workshop in conjunction with design agency MadPow (hired for initial research exploration).

Additional Considerations

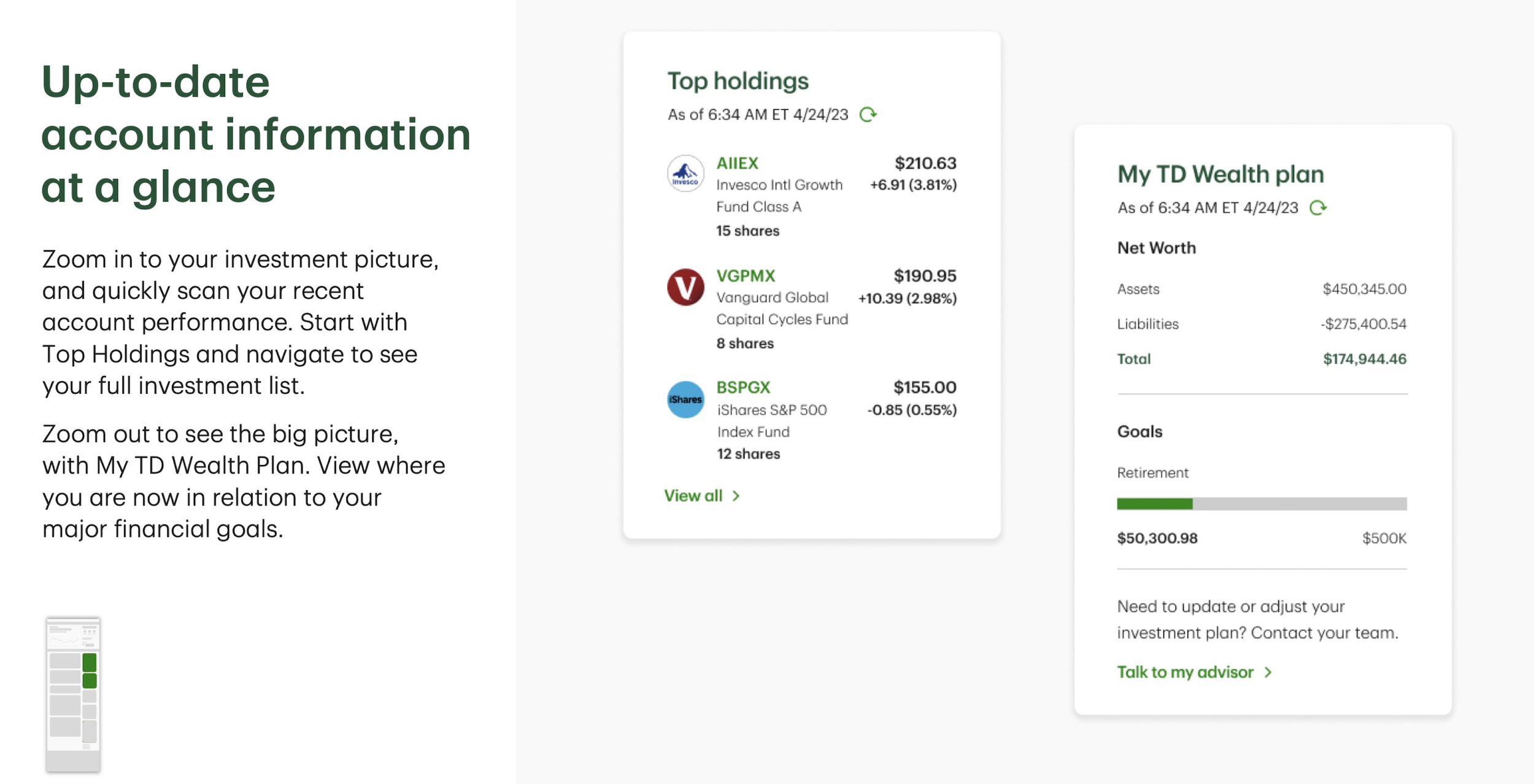

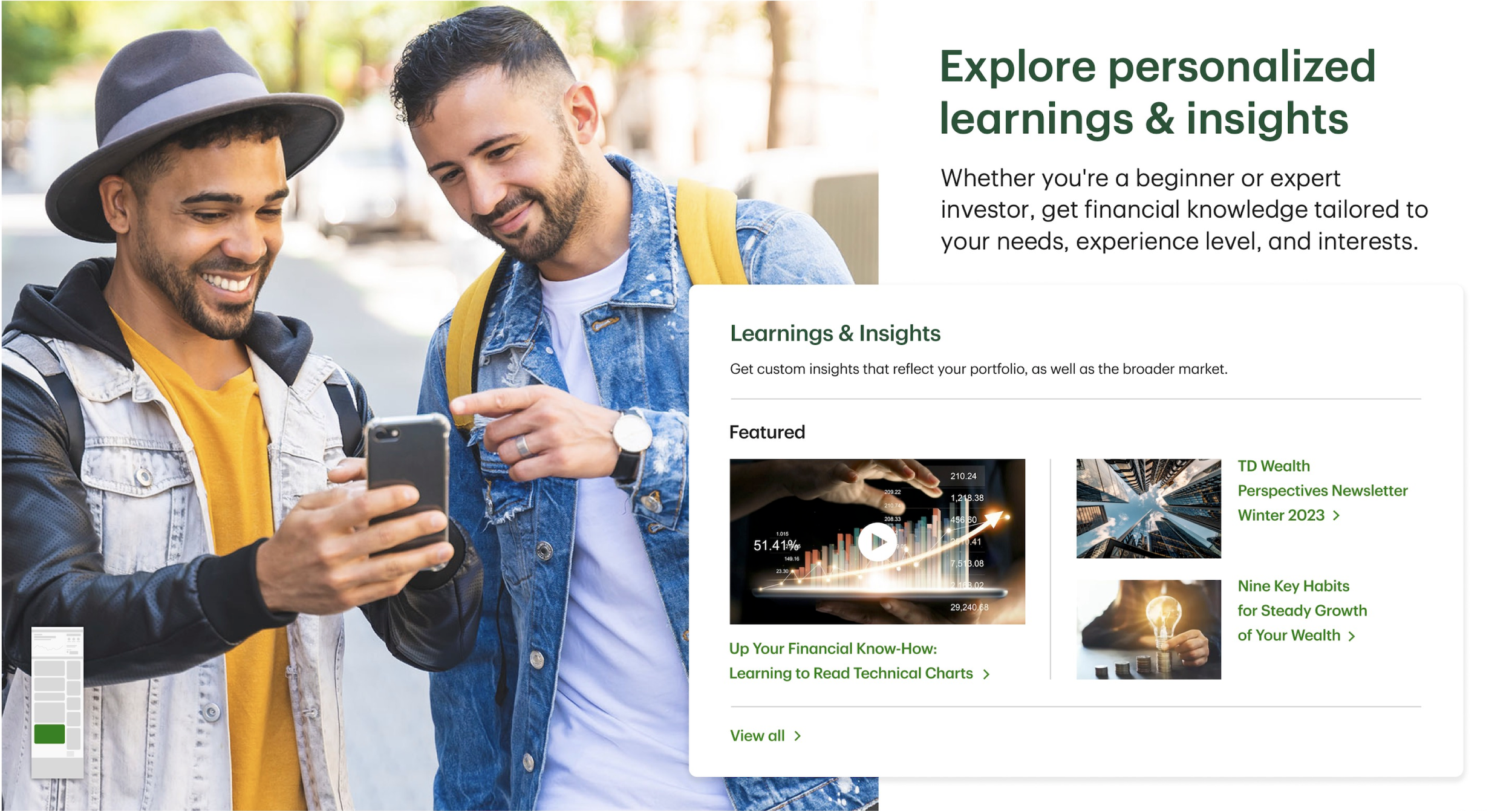

Investor insights

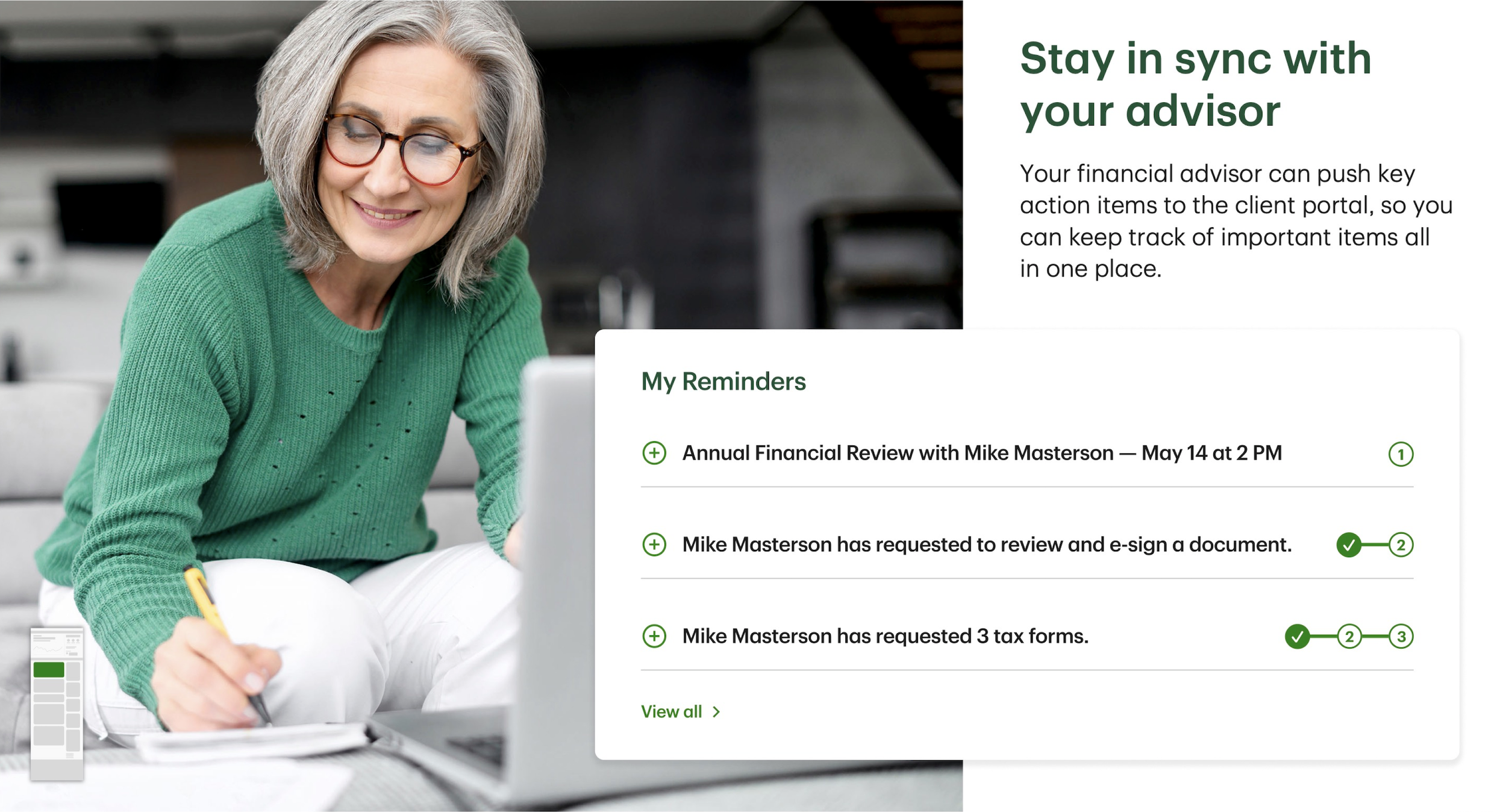

We were asked to incorporate advisor-led financial insights, in addition to financial education.

Intuitive platform

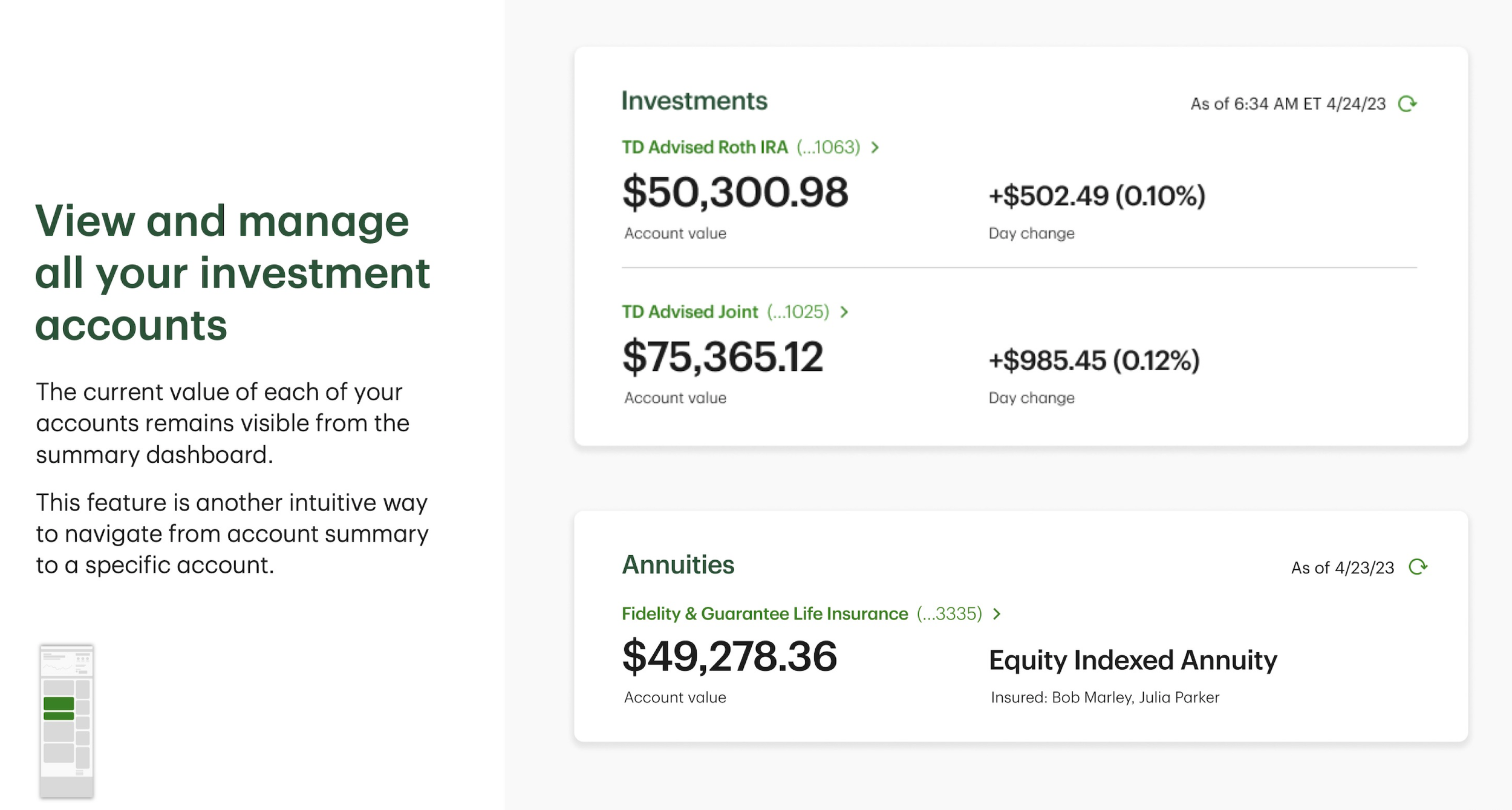

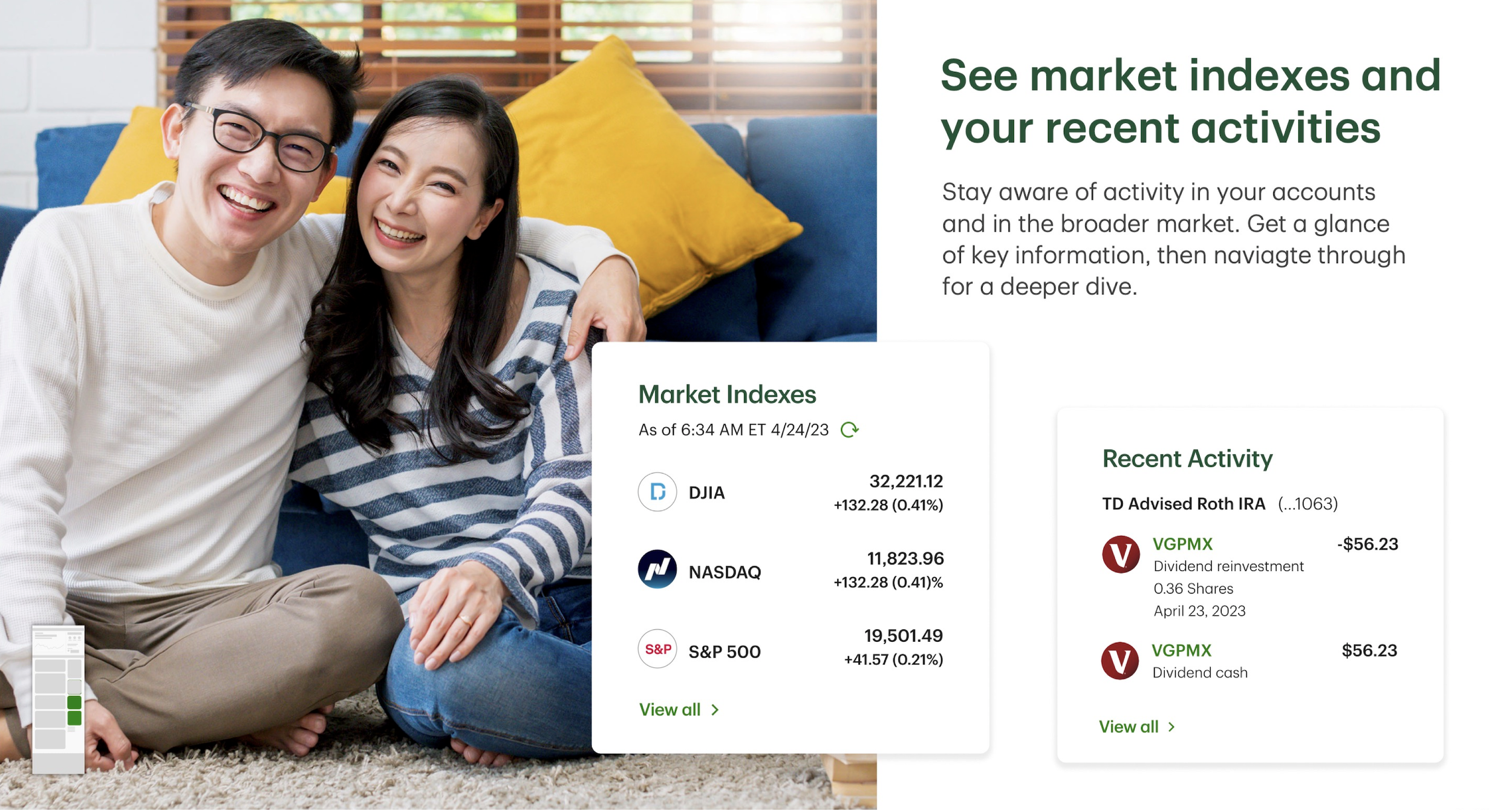

The experience should be easy to navigate, serving data-rich information that’s findable and digestible. It should feel like a TD customer first experience.

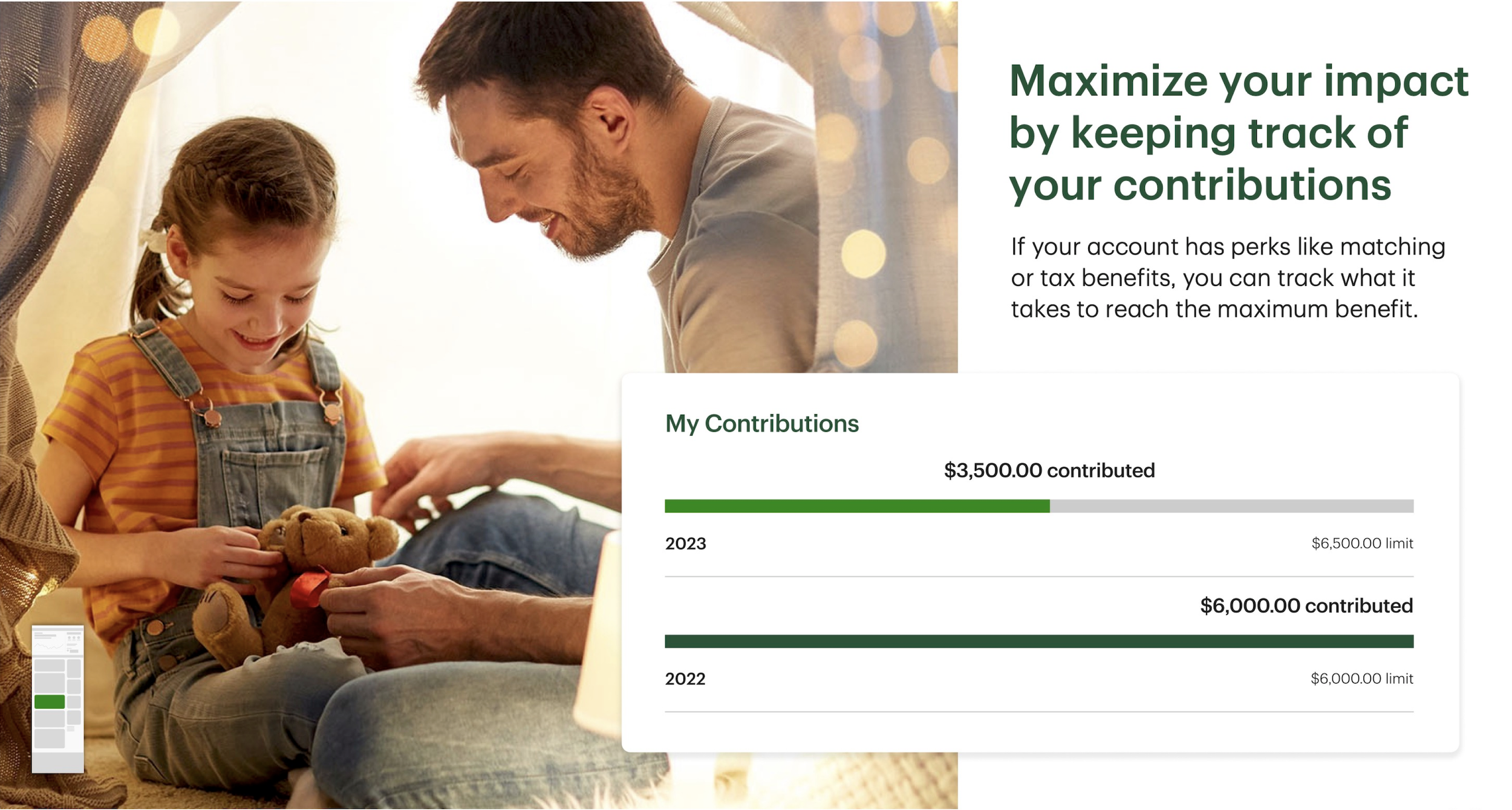

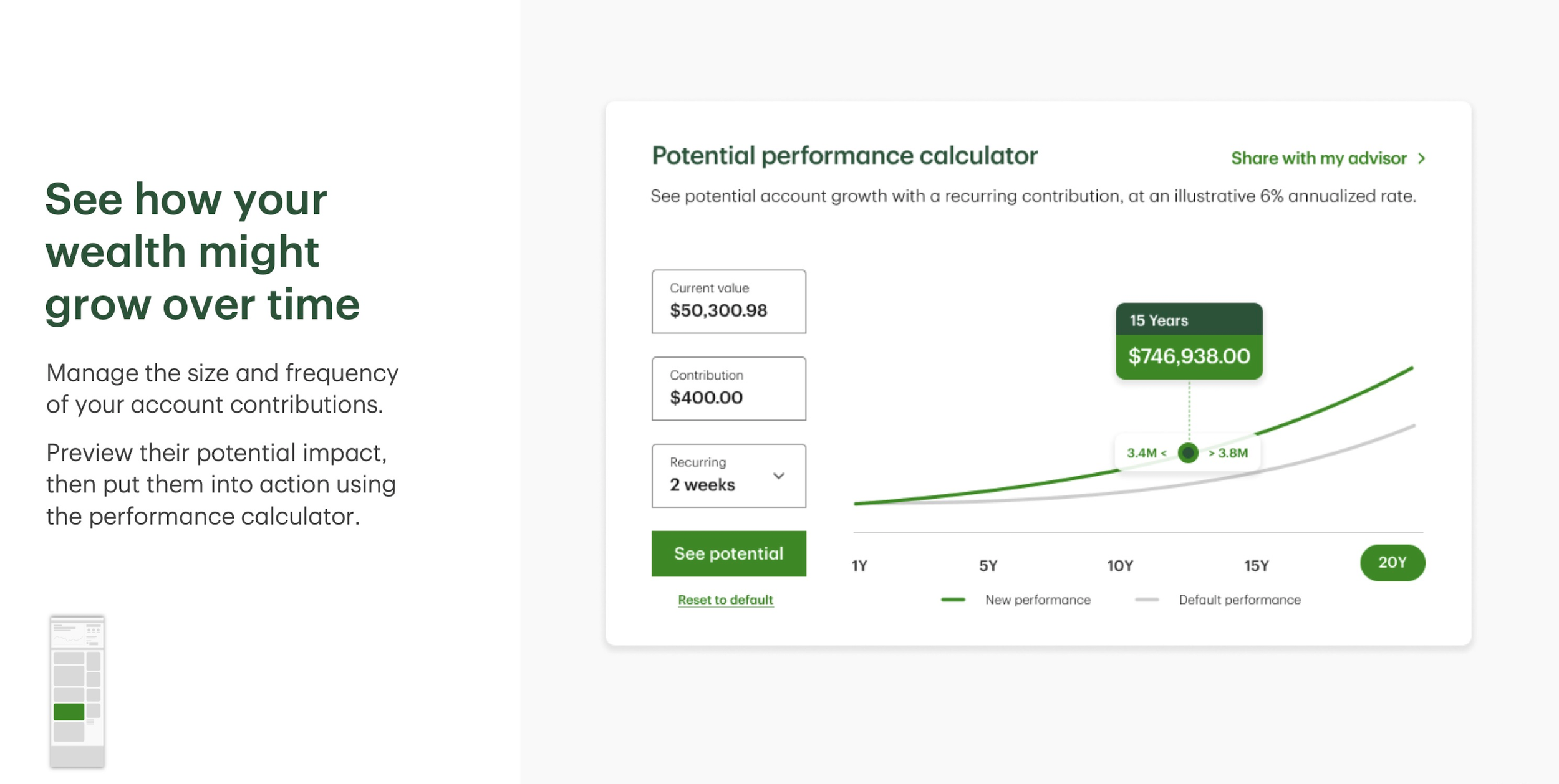

Portfolio, performance and reporting

The experience should incorporate performance charting, portfolio holdings, balance details, account activity, documents (such as statements and tax forms), and other reporting features.

Note about mobile: At first, integration with the TD mobile app was a day one imperative, however, this didn’t align with the platform Mass Affluent and High Net Worth customers were largely using. In addition, native mobile first on day one didn’t address the need for a secure retail investor experience within the TD.com website. It was decided to address the website first, with a responsive design optimized for both desktop and mobile.

Inputs and evaluation

To align our design and business goals, we evaluated competitors and existing TD systems. Working with our stakeholder team, we then prioritized day-one needs for our concept level design.

Competitive analysis

Analysis of 20+ direct and indirect competitors to understand digital trends and best-in-class user experiences.

Product prioritization

Coordination with product team to identify day one platform needs, high level requirements, and design features informed by our initial discovery.

Existing systems evaluation

Collaboration with BAs and Product team on walkthroughs of existing third party systems to distill the current landscape.

Design generation

Creation and evaluation of concept design for TD Wealth client portal, capturing HLRs in an intuitive, integrated interface.

Our design process

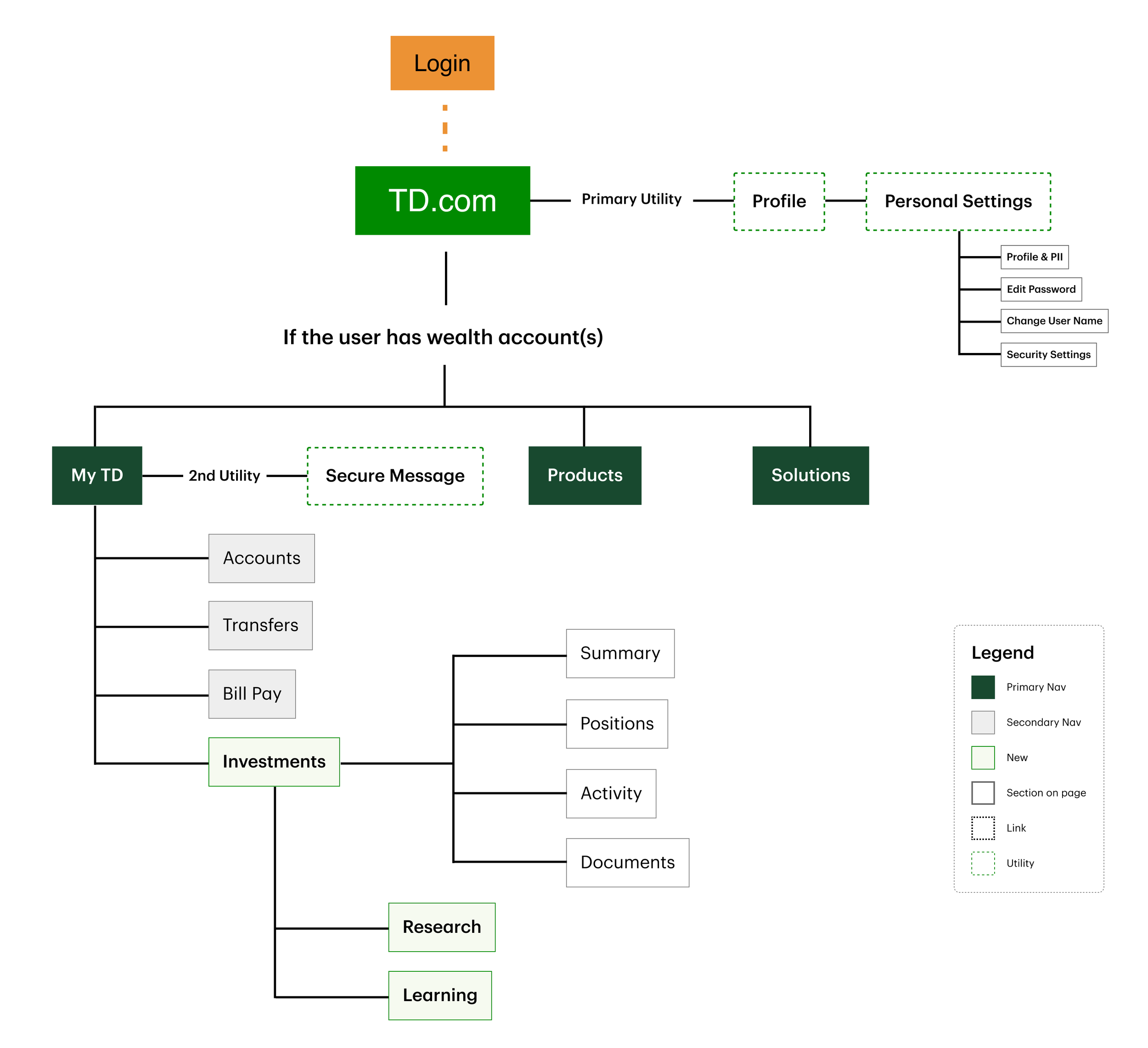

Crafting the information architecture

Once our ethnographic studies and concept prioritization exercises were concluded, I partnered with our Ops team to scope and build the initial design team I oversaw during this project. As a team, we started by mapping out a site architecture and combined wealth and retail banking account level vision within the TD site.

Sketching and low fidelity explorations

Kicking off our design phase:

I ran a workshop with the design team in order to get our creative juices flowing and the team excited about tackling such an intricate, high stakes project. We started by simply sketching as a group and pulling together design inspiration, which included both fintech and financial services, as well as other experiences from different industries. Taking into consideration the high level requirements from our prioritization workshop, we then produced wireframes of the basic client portal architecture, getting input and feedback from key stakeholders during weekly checkins.

Experience highlights:

Reactions to the integrated wealth client portal:

Recommendations for future discovery:

Added thoughts:

During our research phase, themes around women in investing emerged, which helped to shape a sister strategic initiative at the bank to continue exploring this market. Women, in particular, are under represented in the investment landscape, but tend to gravitate toward investment advice and wanted relationships with their advisors that could evolve over the course of their lifetimes. In a McKinsey study on women in US wealth management, up to 70% of women switch advisor relationships within 1 year of their partner dying. Women, generally, are looking for an advisor that feels like more of a personal relationship to them. With women set to inherit and command increasing rates of household wealth, how could TD better position itself to serve this market?

A few of the common themes we saw emerge from our research directly correspond to broader national trends.