Objective

My agency was the partner of record with US Bank that built Pivot, a trade and reporting platform for their global banking division. For this project, we were tasked with digitizing an onboarding service for Pivot within their Trust & Custody business. I was partnered with another principal consultant, to execute and facilitate a discovery research phase for this initiative. After presenting our findings, I led the concept design phase.

Problem statement

The RIA (Registered Investment Advisor) Account Opening experience had been a largely offline process where retail clients would work with their advisors to open new accounts. PDF forms would be emailed or printed and physically mailed between advisors, end clients, and US Bank. Retail clients ranged from individuals opening IRAs and simple investment accounts, to Startups and Municipalities opening and funding complex corporate institutional accounts. Advisory firms spanned the gamut from small “mom and pop” style businesses to large firms handling hundreds of account openings per month. All were in agreement that current onboarding processes through US Bank (as the custodian), were in desperate need of a streamlined digitized experience.

Project background

The project was a result of US Bank’s relationship managers hearing from their brokerage clients that retail customers were starting to demand a digital experience with more transparency into the account opening process. Many mentioned using competitors like Charles Schwab and Fidelity. However, unlike the competition, US Bank’s RIA clients are performing an advisory service for their retail clients as the customer segment skewed high net worth with many accounts being complex in nature (like Trusts or Estates). So the solution was not meant to be self-service, like a Fidelity, but rather, a streamlined digital interaction between advisories, retail clients and US Bank.

Solution

Responsive web based application that feeds seamlessly into US Bank’s back office BPM systems.

My Role

Lead Product Designer

Project Deliverables

• Stakeholder interviews

• Ethnographic research

• Content audit

• BPM systems analysis

• Product definition

• User journeys & flows

• Medium fidelity prototypes

• Visual design

Key insights

“In order to get a younger generation, folks like myself in their early 30s, they’re used to doing everything online. I don’t know how we’re going to continue to grow our business if we don’t have that capability. ”

“I think more than 50% of our applications sent to US Bank being returned to us is horrible. So there’s got to be change somehow on our end.”

Framing our research

Research planning

Our research timeline – research sprints are broken into 3 week cycles for a total of 12 weeks on this phase. We included regular check points with key people from our stakeholder team to continuously track and adjust as needed.

Outcome goals

Concluding our alignment phase, we synthesized goals and obstacles to align on project directives. These were presented back to key stakeholders for any additional input before starting our field research.

Potential obstacles

Advisory firm profiles

Below are a few examples of Advisory firm profiles we synthesized from our contextual interviews. We used these as a visual artifact to help give emphasis to differing needs across advisories. Some advisories proved more specialized than others and geared towards certain client types; while others tended to be more generalist.

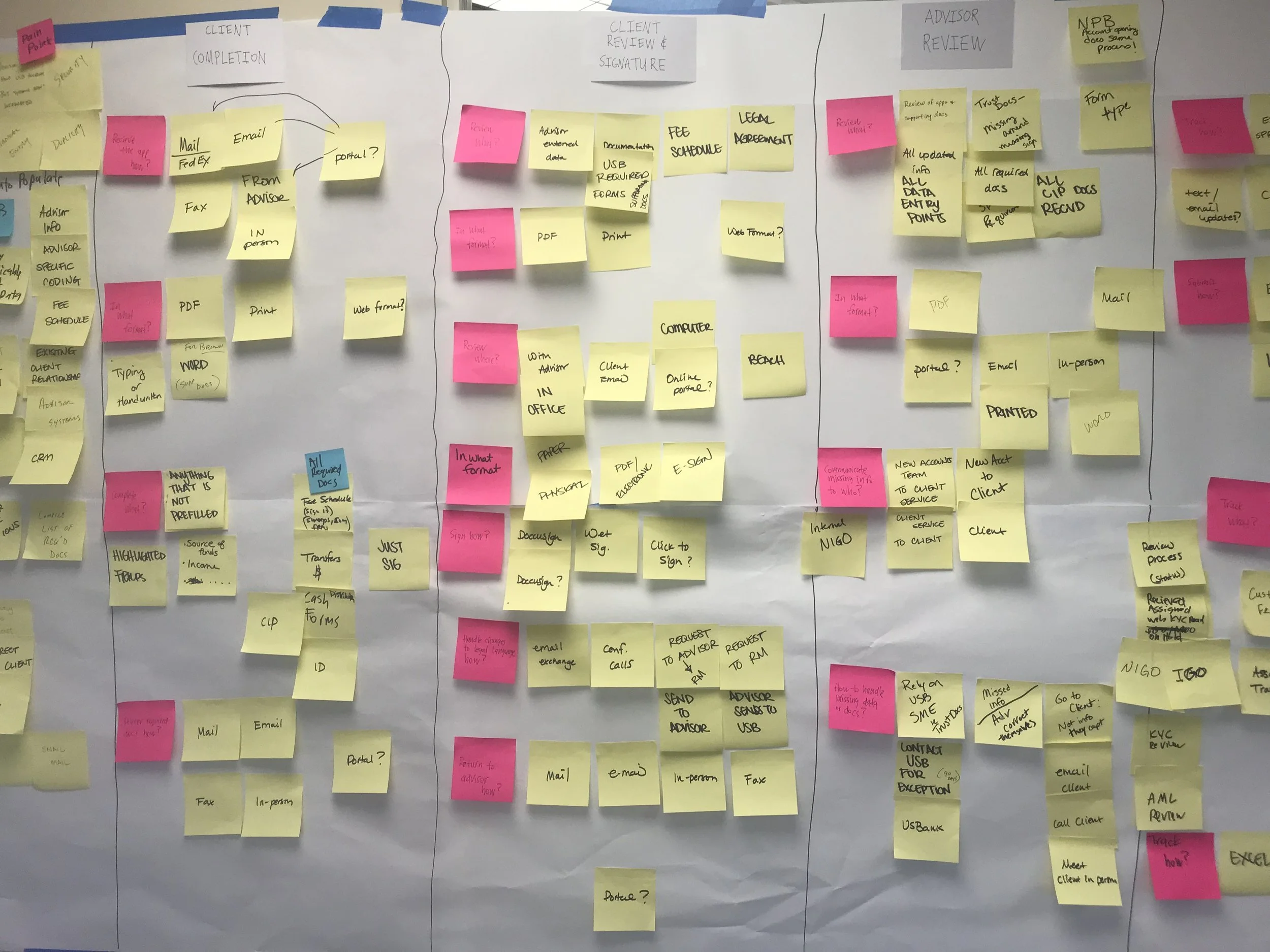

Current state: Advisory onboarding journeys

We also mapped the customer experience journeys, allowing stakeholders to see the application process between advisories, end clients, and the US Bank onboarding team. By doing this, we were able to surface the differences between onboarding processes at different advisories as well as pain points in the account opening process.

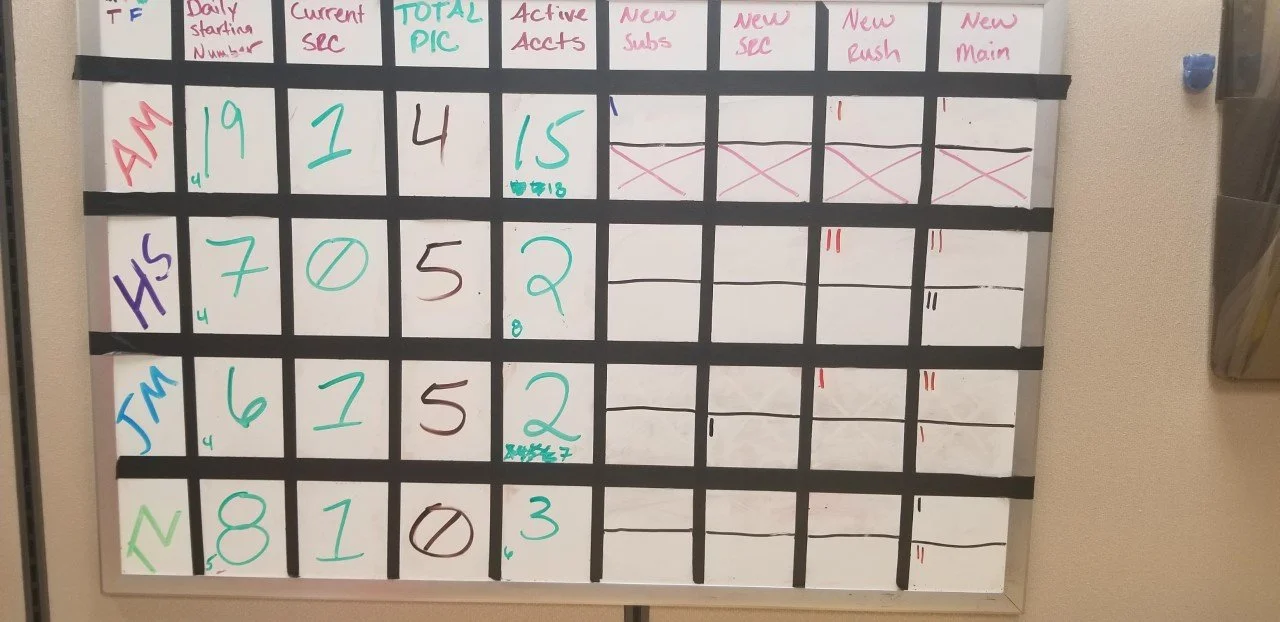

NIGO = Not in Good Order. Internal advisory NIGO rates are self reported.

At a larger firm, internal teams capture higher internal NIGO rates before submission to USB.

Experience framework

While developing Pivot, our agency crafted an experience framework specifically for the global banking division. Framework pillars include: Service, Transparency, Seamless Delivery, and Efficiency. Our research insights were delivered within these framework pillars to help facilitate consistency in communication with our stakeholders.

Advisory firm insights

Service:

How people, systems, tools, and technology support US Bank’s strong customer relationships and brand trust.

Transparency:

Keep the customer continuously informed about account status and services.

Seamless Delivery:

Ensure that the system performs optimally. Help customers get in and out of the system quickly.

Efficiency:

Leverage insights that will allow customers to optimize their processes and scale business practices.

Delivering a solution

Recommended ideas for exploration

1. Digitized smart form

Convert the paper agreements to an interactive, digital format that asks the right questions for owner and account type.

Key Insights:

Guide the user to the appropriate custody agreement

Pre-populate any existing data

Ask appropriate follow up questions when needed

Can be completed either by the new accounts team at the advisory firm or underlying client

Force data entry for all required fields prior to submission

Updates to data fields or legal language would be automated, instead of manually sending a set of new docs

2. Secure documents portal

Allow clients and/or advisory firms to upload all required documents to the custody application and send everything securely at one time. Eliminate the need for docs being emailed via secure mail.

Key Insights:

Would prevent an application from progressing without all required docs being attached

Would also help the larger advisory firms with larger teams reduce their internal NIGO rates as a new account application could not be sent to the internal new account team unless all required docs were attached

Firms could still collect physical documents or scans from their underlying clients, and then upload them

3. Use of e-signature

eSignature is a core piece of functionality that has to be offered to facilitate a digitized version of the custody agreement.

Key Insights:

Flexibility is key, as some advisory firms may be slower than others to adopt eSignature, while firms that do adopt eSignature may also want to optionally accept a hard signature for certain clients.

4. New account tracker

Create a tracking repository of all account applications both current and historical that can provide a centralized record for all account-related information.

Key Insights:

Aggregate all new account applications in one spot

Provide a historical record of all new accounts

Provide a roll-up dashboard view of key new account metrics

Provide a trackable status of each application

Notification/status update when the account is open and available for funding

Provide awareness of when Pivot provisioning has been completed

Link to the Pivot portal within “Welcome Emails” sent to the client directly

5. Data integration

Some clients are using third party systems (like Pegasystems) to track accounts. Allow clients to integrate data with US Bank systems via an API.

Key Insights:

Structured data from the digitized smart application populates across core BPM systems to improve time to SLA

Specifically, larger advisories are working with third party technology like Pega Systems to create digitized versions of US Bank’s custody agreements to better facilitate their internal processes

Integration with application data

Upon submit, an Advisory’s application would send structured application data and documents to US Bank’s internal BPMs, including their onboarding team queue.

Receiving structured data from a third party system

Same idea as above but showing an application generated via a third party system (like Pega) and integrating with an internal onboarding queue.

Initial concept sketches

Examples of initial sketches were produced through an ideation workshop with key stakeholders. Below are examples of sketches that became a starting point for the initial design phase.

New account tracker

Ability for an advisory to track all account openings

Status indicators across several metrics including: accounts opened, applications In progress, and NIGO rates

Advisors can view individual applications and statuses within the Application list

Ability to create new applications from the dashboard view

Digitized smart form

Advisory view: ability to create a new application for a new or existing client

Pre populate any existing client data – if applicable

Pre populate all firm data

Share with a client

Future state E2E experience journeys

Before jumping into the design phase, I presented the product team with a map of end to end future state user journeys across the digital smart form and account tracker. These were based on in person journey mapping workshops with our stakeholder team. I needed to “play back” all the various touch points across the proposed experience journey in order to level set expectations. Creating a visual map of where each user (advisor, retail client, US Bank) interacted with each other within the account creation process, proved really helpful for the team to orientate around product requirements. Our goal was to streamline account opening from 24-48 hours to less than 24 hours turnaround between the advisory and US Bank Investments onboarding team.

Journey mapping workshop

Interface design

Below are examples of the interface design across different touch points (advisor, end client). The smart form can be broken into three experiences: advisor application creation; retail client application completion; and finally, advisor review before submitting to US Bank. Each stage of the smart form process can be tracked by the Account Tracker module (which houses the advisor version of the smart form).

The smart form is designed to be a responsive web application for MVP. Plans for a smart form integration with the Pivot native mobile app were flagged as a day two need.

Advisor’s view: Pivot Portal Accounts Dashboard

Advisor’s view: Pivot Portal Application Detail

Customer’s view: Smart Form with e-sign (docusign integration)

Customer’s view: Smart Form submission (documents captured)

Added Context

During the research phase, we flew out to meet US Bank’s Investments onboarding team. We did in person journey mapping of their current experience opening accounts for advisory clients. What we discovered were duplicative processes, hard to navigate interfaces, BPM systems that did not share databases and lack of application tracking. So the team spent much of their time re-keying data and re-uploading documents to different systems. We presented these findings separately to our stakeholders as insights to help generate awareness around current internal friction points. Addressing these would enable more streamlined, less manual processes with faster time to account opening and funding.

Manual application tracker for the US Bank team